Business and Computer Programs

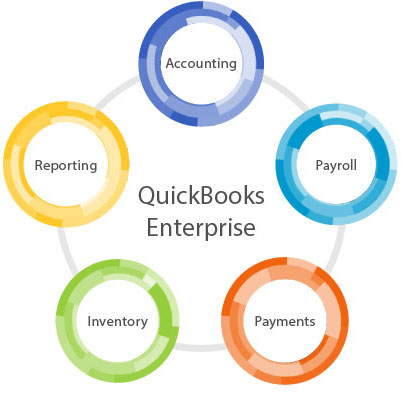

Quickbook Accunting:

The objective of this course is to provide instruction in a computerized accounting program that emphasizes payment application, receipts, deposits and financial statements. The activities of this course are designed to introduce a student to or increase a student’s existing knowledge in computerized software applications. Upon completion of this course, students will be able to perform accounting procedures and develop financial reports. For a beginner student with little or no typing or computer skills, the prerequisites for this course are Keyboarding, Introduction to Computers, and Introduction to Windows. This course is tailored to meet the need of a beginner ant to enhance the existing skills of those who have knowledge in QuickBooks.

Select your business type to learn more

- Set up your company

- Move around QuickBooks...EFFICIENTLY

- Get help...FAST

- Everyday Transactions

- Selling: invoices, sales receipts, payments, deposits, credit memos, and customer statements

- Buying: bills, bill payments, checks, bill payment stubs, bills vs. checks, and credit memos

- Inventory: purchase orders, receive items, adjust inventory

- Sales Taxes: set up, adjust, pay, and report sales taxes

- Banking: bank reconciliation and locate discrepancies, online banking

- Special Transactions

- Give and receive refunds

- Void vs. delete a check

- Apply credit memos

- Tips & Tricks

- Special "Window" tricks

- Clean up lists (delete, hide and merge)

- Sort and customize lists

- "Collapse" financial statements

- Show P&L by month, or as a percent of income

- Understand Accounting

- Really understand your financial statements

- Setup the chart of accounts

- Change and fix the chart of accounts

- Cash vs. Accrual accounting

- Use general journal entries

- Setup and use subaccounts

- End of Day Special Q&A Session

- Set Up and Pay Employees

- Setup employees, payroll items

- Track time and invoice time

- Process paychecks

- Modify paychecks

- Make tax deposits

- Prepare tax forms

- Summarize payroll data in Excel

- Work with Reports

- Add, delete, resize, and reorder columns

- Filter and format reports

- Save reports and create memorized report groups

- Advanced Features

- Use petty cash

- Use multi-user

- Password protect QuickBooks

- Update QuickBooks

- Work with Microsoft Word and Microsoft Excel

- Close the books

- Find transactions FAST and other time saving features

- Work with the accountant's review

- Protect your QuickBooks data

- Tips & Tricks

- Keyboard shortcuts

- Add custom fields

- Tailor company preferences

- Create custom invoices and other forms

- Add logos and custom fields to forms

- Tricky Transactions

- Use online banking

- Handle bounced checks...easily

- Enter customer down payments/deposits

- Setup automatic transactions (memorizing transactions)

- Use credit cards